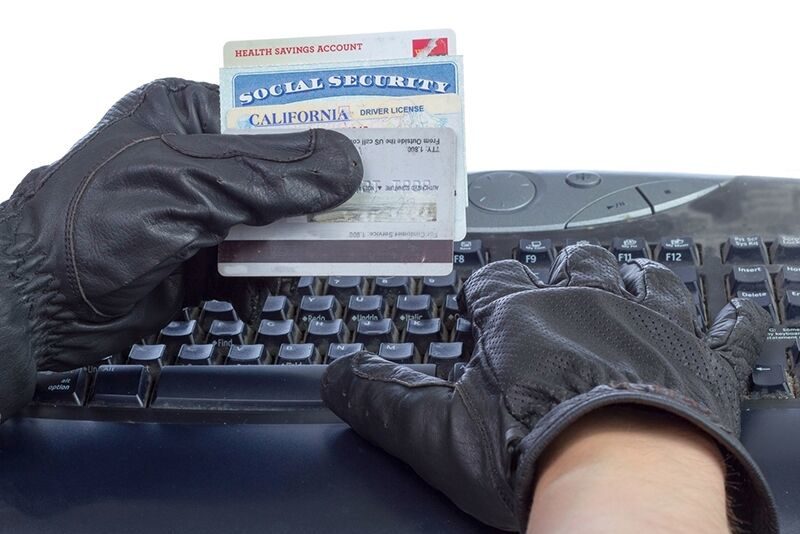

Try out these tips to protect yourself online.

In the digital age, it’s more important than ever that you take steps to secure your private information. Unfortunately, as technology advances, so do the skills of cyber criminals and hackers. If you want to secure your personal information, then try out these tips to protect yourself online.

The first thing you should do to protect yourself is make sure that all your devices are secure. Any device that has access to the internet should have regularly updated anti-virus software, anti-spyware, updated web browsers, and strong passwords. Additionally, make sure portable devices such as your smart phone, tablet, and even flash drives have security applications and are encrypted just in case they are lost or stolen.

- Review Your Personal Data Files

It’s possible that someone has stolen your identity without you even realizing it. That’s why you should review personal data files, such as your credit report, to check for any suspicious activity. Check for issues like new accounts, judgements, liens, bankruptcies, and other indicators that someone has been using your identity to open credit cards and make other financial decisions.

If you so much as suspect that you are a victim of identity theft, then act quickly. Make sure you report unauthorized charges, close or freeze any compromised accounts, and contact your creditors and bank to inform them of the situation. You should initiate fraud alerts and security freezes on your accounts and request credit reports from all three of the major credit bureaus so you can review them for any for any issues. Then, report the issue to the police to ensure that things do not go further.

Try out these tips to protect yourself online. Want another way to stay safe? Then make sure you have the proper insurance protections in place. To find the right policies to fit your needs,

contact the experts at

Fuller Insurance Agency. Located in Southern California, we are ready to assist you with all your personal and commercial coverage needs.