Does your home policy offer coverage for internal damages?

As a homeowner, you understand that your

homeowners insurance in Los Angeles, California, is designed to protect against sudden, unexpected perils and accidents. While your policy is extremely helpful if your home is damaged in a storm or fire, what happens if your home sustains damage unrelated to external issues?

Here's what you need to know about your home insurance and internal damages.

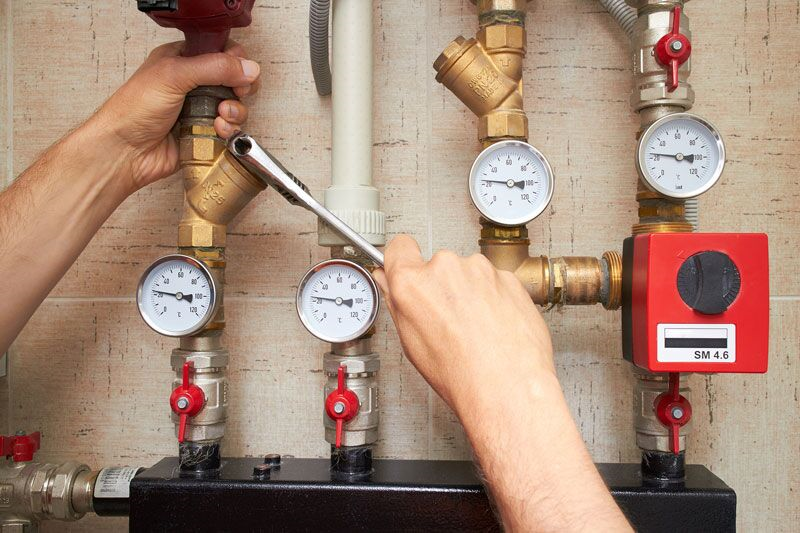

Your home insurance may offer coverage for water damage, depending on how the damage occurred. For instance, if water damage is the result of an unforeseen issue, such as a burst pipe, then your policy will likely offer coverage. Additionally, if water damage is caused by a faulty appliance, then your policy will probably cover the damage, but will not pay to repair or replace the appliance. Water damage caused by neglect or gradual issues will not be covered by your insurance. Water damage caused by sewer backup and floods is also excluded from coverage.

Typically, your homeowners insurance will not cover any damage that your pet has caused to your home or personal belongings. Most standard home policies specifically exclude coverage for damages caused by pets or domestic animals (including insects and rodents). However, the personal liability portion of your home insurance will offer coverage for the damage or injuries that your pet causes to a third-party.

Your homeowners insurance will offer coverage for broken appliances if they are damaged due to a covered peril. If an appliance breaks down due to lack of maintenance, then your insurance may cover damage to your property and belongings, but it will not cover the cost of repairing or replacing the faulty appliance. Your home insurance will also not cover the cost of repairing or replacing appliances that breakdown due to mechanical failures. This coverage can be secured through a home warranty instead.

This is what you need to know about home coverage and internal damages. Do you have additional questions about your

homeowners insurance in Los Angeles, California? If so, then contact the experts at Fuller Insurance Agency in Southern California. We are ready to assist you with all your coverage needs today.